Fintech Disruption — Five sectors being disrupted by FinTech

Innovation is here to stay: five sectors most likely to change in the next five years

FinTech is here to stay. As we saw in our first article on FinTech banking disruption – ‘An Overview of Fintech Disruption‘ – mobility and digitization have not only radically overhauled consumer preferences in retail banking over the last few years, they’ve also completely transformed the business practices that compete with banks in the landscape of financial services.

Over 70% of the financial institutions surveyed by a recent PwC Global Executive Summary see themselves losing revenue to FinTech companies in the next five years, and 80% plan to increase partnerships with FinTech services over that given period of time.

In the same survey, some 1297 respondents were asked to predict which sectors they saw as most likely to be affected by FinTech banking disruption, with consumer banking taking the top spot, followed by fund transfers and payments, investment and wealth management, commercial banking, and insurance. Let’s take a closer look at the reasons why these sectors are most likely to change.

Consumer Banking

Nearly three-quarters of the executives surveyed in PwC’s report estimated that consumer banking was the sector most likely to be affected by FinTech banking disruption in the near future. This can be explained by the tremendous shift in consumer preferences and the rapidly evolving technologies that have accompanied them over the past few years. Mobility and transparency are key for a generation of customers who bank primarily from their smartphones, and who expect financial services to be available anytime, anywhere.

Startups have responded to these new demands with impressive results, providing single-product solutions that are cheaper and more convenient than those provided by banks, who are typically burdened by regulation and the costs of offering a wide range of services at once. Companies like Monese, N26, and Revolut have led the charge of FinTech banking disruption, and now offer mobile accounts that can be opened without an address or credit history, and that allow customers to spend and transfer money abroad without fees.

This flexibility, combined with a noted emphasis on transparency and user experience, have fixed a whole new set of consumer preferences and expectations onto the financial services market. Cost-effective, omnichannel models are the new norm, a development that’s increasingly difficult to deny — and compete with — for incumbents.

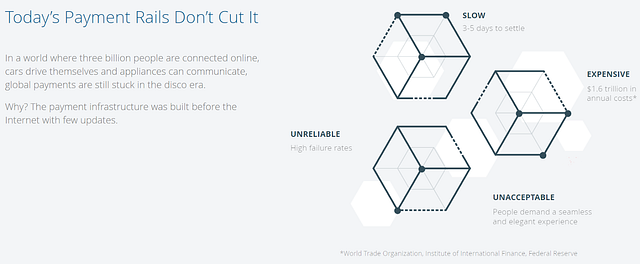

Fund Transfers and Payments

It’s no surprise that payment transfer services, which are closely linked to consumer banking, are cited as the second most likely sector to be affected by FinTech banking disruption in the same PwC report.

As new retail banking models continue to pose challenges to financial institutions, so do flexible offerings for fund transfers and payments.

Not only do companies like Stripe, Klarna, and Wise provide fast, mobile-friendly user experiences, they also offer real market prices, something that remains complicated for banks to match due to the regulatory and cost-related reasons noted above.

What’s more, even if financial institutions do have established online banking platforms, they haven’t necessarily developed mobile banking systems, putting them one step behind in a practice that’s well on its way to becoming standard in the smartphone era. As FinTech banking disruption shifts the sector further towards customer-centric offerings focused on mobile channels, it’s increasingly important for banks and financial institutions to integrate innovative services into their payment transfer models.

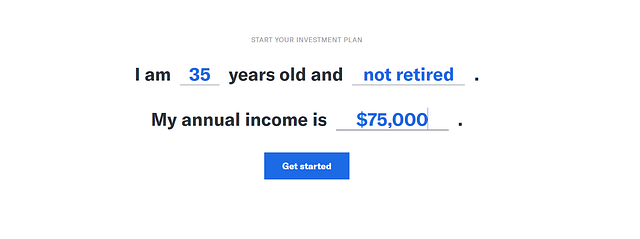

Investment and Wealth Management

In much the same way, the investment sector is being completely overhauled by FinTech banking disruption. Banks typically charge hefty brokerage fees in exchange for access to trading platforms, which up until recently had been reserved for the wealthy. But InvesTech services like ScalableCapital and Betterment now offer safe, inexpensive alternatives to banks, which have both opened the investment market to new customers and turned existing players away from financial institutions – showing us FinTech banking disruption in perhaps it’s purest, most raw form as a result.

The same is true of P2P lending services, as companies connect borrowers and investors directly through online marketplaces, democratizing market access to customers with credit histories that may have been refused by banks and making it easy for investors of any kind to diversify stock portfolios and predict risk at a low cost.

Here too, digital technologies and shifting consumer preferences are building off of one another to provide significant challenges to financial institutions: over a third of global executives see this sector being changed radically by FinTech banking disruption over the next five years.

Commercial Banking

Commercial banking isn’t immune to the changes brought by FinTech banking disruption either. In Europe, the revised PSD2 directive has opened the customer data held by banks up to third parties, leading to a new wave of digital platforms that have had SMEs and corporations alike turning away from financial institutions in favor of cheaper, more flexible, and more innovative solutions.

Echoing the changes that have taken place in retail banking, services like Penta now offer business accounts at a fraction of the cost typically associated with opening them in a bank. Startups like Ripple provide cross-border payment services based on blockchain technologies, making it easy for major companies to cut costs, save time, and increase revenue in ways previously unthinkable.

Finally, risk management companies like ComplyAdvantage are focusing on data science to create innovative, and highly successful, risk-screening financial services — which means that everyone in the sector has to keep up, including the banks who – through being obliged to share their data – gave rise to the very competitors they sought to avoid.

Insurance

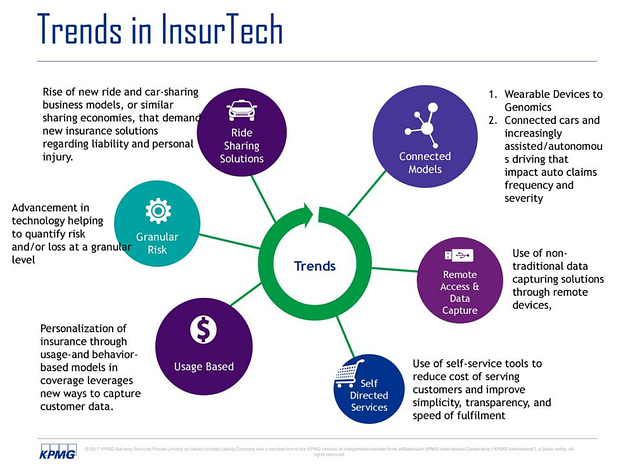

Insurance comes in at number five on PwC’s global survey of industries most likely to be affected by FinTech banking disruption, with a quarter of respondents seeing it undergo changes in the next five years.

InsurTech disruption has taken much the same form it has in other areas of financial services: tapping into unused markets and using technology to cut costs and better meet the customer demands of the smartphone era. Oscar and Lemonade, for example, both provide insurance services delivered through mobile channels, with minimal pricing and fast turnaround times when paying premiums to customers.

Once again, single-product solutions, which are less regulated, easier to implement, and more adaptable to optimizing user experience, have provided fierce competition to the sector’s incumbents.

Is FinTech banking disruption an opportunity?

In each of these cases, user-facing businesses have been able to offer powerful, inexpensive services through new technologies – something that banks, often burdened by older IT systems and heavier regulation, have struggled to match.

As consumer preferences change, so do the user experiences built around them, and in turn, so do the expectations they produce. The financial services market hasn’t simply seen new players come knocking on its doors, it’s gone through a complete transformation of the pace and forms of consumer demand.

Innovation is no longer an advantage but a necessity in the market. Though this may seem overwhelming at first glance, there’s hope — and even tremendous opportunity — for success here, especially where data is concerned. That’s where Mooncascade can help.

IS YOUR BUSINESS BEING AFFECTED BY FINTECH BANKING DISRUPTION?

If you’re struggling with the effects of FinTech banking disruption on your business and would like to get a fresh pair of eyes to have a look at your business case, Mooncascade is here for you. As an experienced product development partner working closely with financial companies, we help our clients to beat the odds and stay on top of the competition. Have a look at what we’ve done for FinTech companies, and get in touch!

What’s more, you can check our beginner’s guide to the world of FinTech just to get inspired by the endless opportunities of financial technologies.